:max_bytes(150000):strip_icc()/graham-number.asp-final-ce508e6a898b4d2394792c6ac3708705.png)

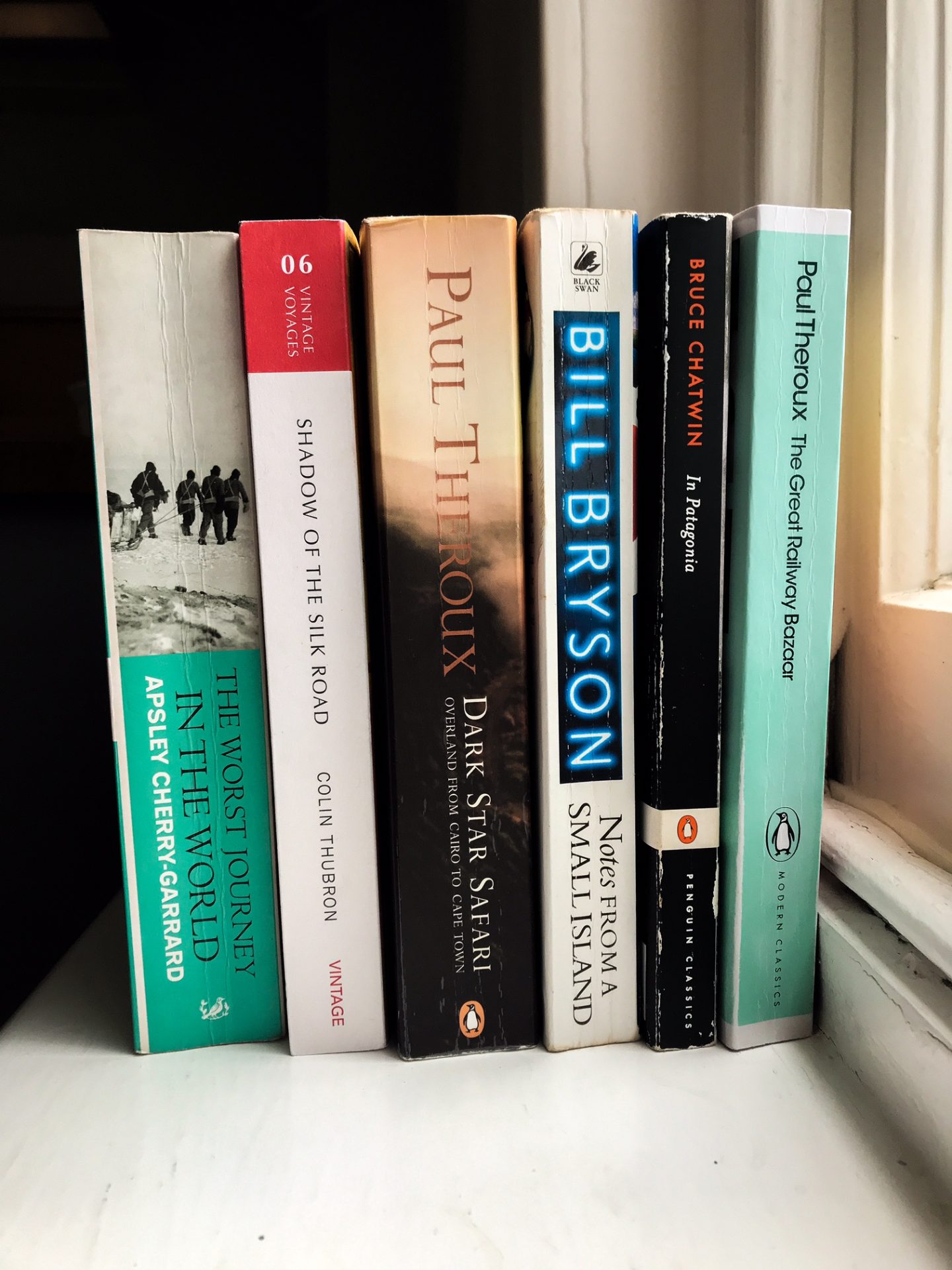

Graham Number: Definition, Formula, Example, and Limitations

The Graham number is the upper bound of the price range that a defensive investor should pay for a stock.

Benjamin Graham Formula & Stock Valuation

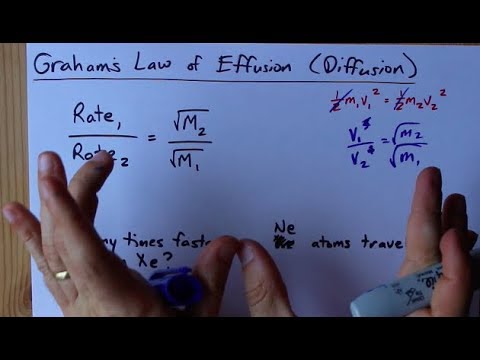

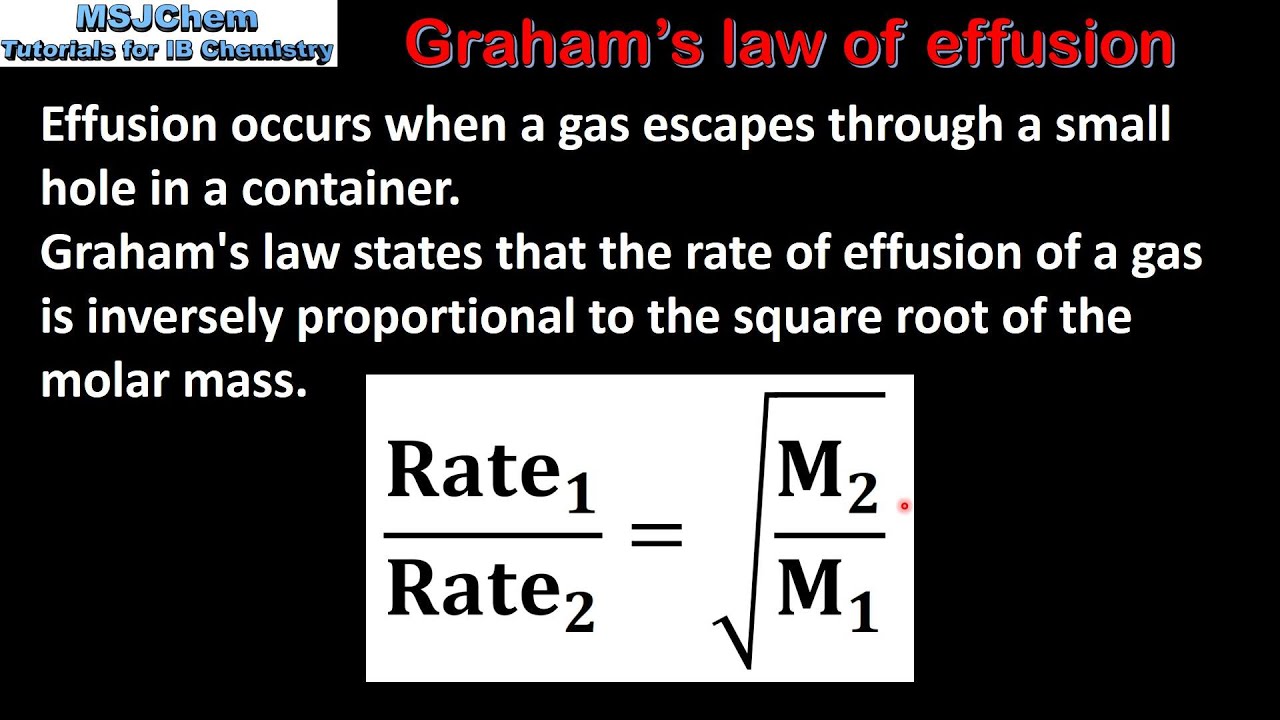

Graham's Law of Effusion (Diffusion) + Example

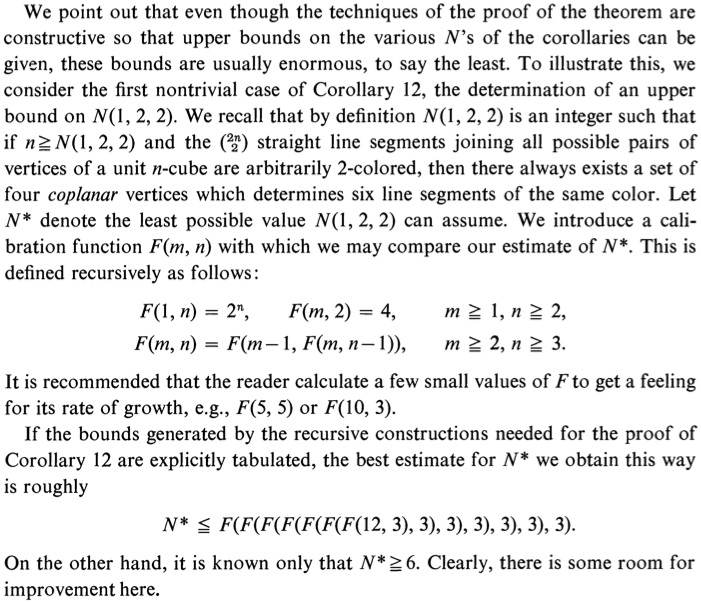

The Fast-Growing Hierarchy. Beyond Extreme-Large-Numbers

C.7 Graham's law of effusion (HL)

2012 Audi A1 Sportback On The Road, 54% OFF

Net-Net - Meaning, Formula, Examples, Is It Still Relevant?

2012 Audi A1 Sportback On The Road, 54% OFF

How to Tell the Difference Between the Graham Formula and the

Large Numbers (page 6) at MROB

:max_bytes(150000):strip_icc()/Outstanding-Shares-66e3dfdfa97140b59e4ad86fb2e70905.jpg)

Using Excel to Calculate a Weighted Average

:max_bytes(150000):strip_icc()/GettyImages-50434559-bd2bbf96c11a4912bcaad7e53ab1deab.jpg)

Benjamin Graham's Timeless Investment Principles

Graham advises enterprising investors that when selecting stocks they should be priced at less than 120% of net tangible assets. How do you actually go about calculating this? - Quora

Using the MIN and MAX Functions in Excel - Video & Lesson

2012 Audi A1 Sportback On The Road, 54% OFF

The Fast-Growing Hierarchy. Beyond Extreme-Large-Numbers