Step-By-Step: How To Claim Motor Vehicle Expenses From The CRA

See the methods and a step-by-step explanation of the five steps to claiming motor vehicle expenses from the CRA as a self-employed individual or an employee.

Insights: Charities are struggling, Cdn tax deductions + used sneakers for $2 million?

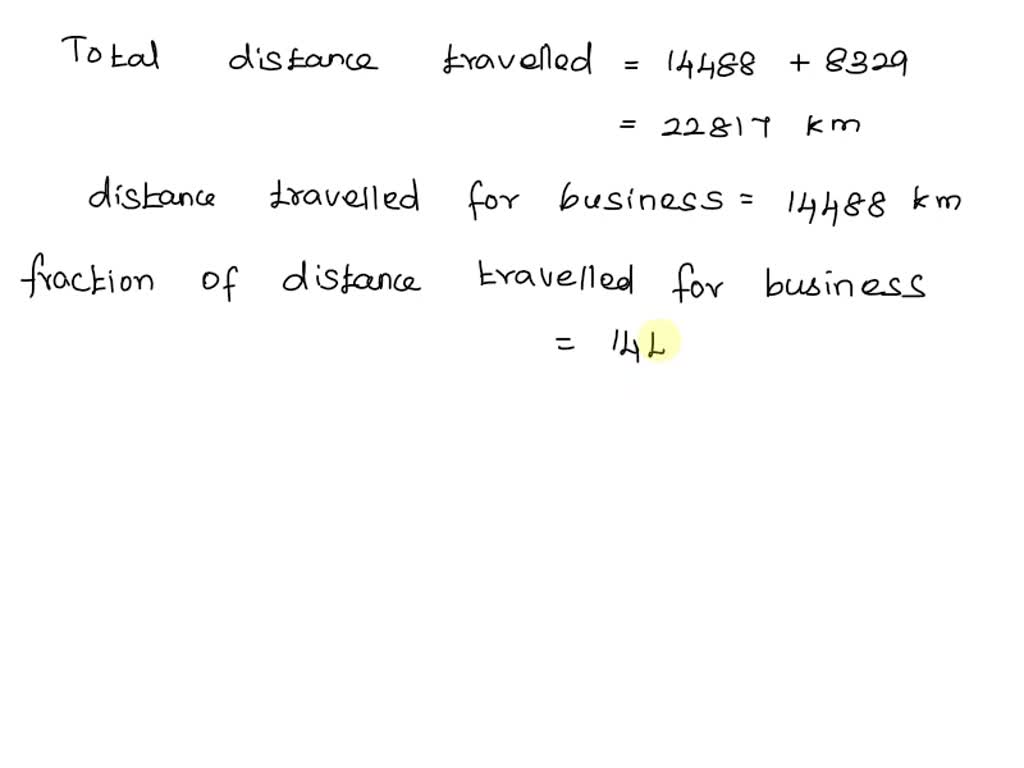

SOLVED: If you use your car for both business and pleasure, the Canada Revenue Agency will usually allow you to report a portion of the costs of operating the vehicle as a

How to Deduct Toll Expenses on your Taxes in Canada

How To Claim CRA-approved Mileage Deductions in Canada

Court backs CRA in rejecting couple's $54,000 moving expense claim

:max_bytes(150000):strip_icc()/businessmanreceiptsgetty-57a624813df78cf45908cf6b.jpg)

CRA Business Expenses (Canada)

2024 Everything You Need To Know About Car Allowances

Application for Settlement of Tax Liability

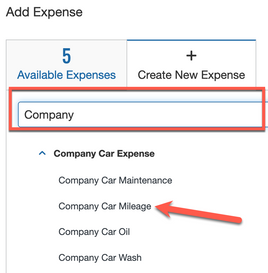

How Do I Submit or Claim Mileage in Concur Expense - SAP Concur Community

AVOIDING CRA AUDITS: WHAT YOU NEED TO KNOW

How the CRA strike will affect your tax returns, refunds, benefits and more

Mileage Rate used to Claim Motor Expenses - Tax Topics

How to Claim the Mileage Deduction & Write off Car Expenses (Uber Eats)