:max_bytes(150000):strip_icc()/StraightLineBasis-27e5ac7651b24572a05ef272c2475554.jpg)

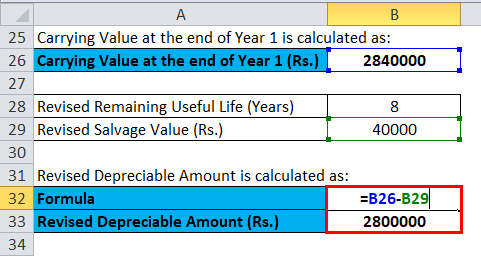

Straight Line Basis Calculation Explained, With Example

5

(590)

Write Review

More

$ 27.00

In stock

Description

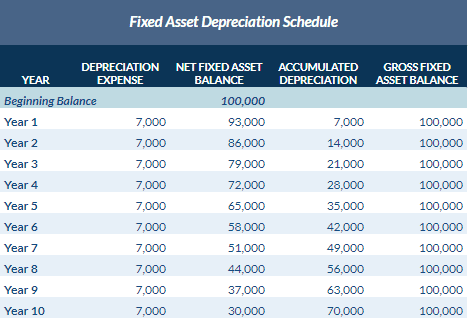

Straight line basis is the simplest method of calculating depreciation and amortization, the process of expensing an asset over a specific period.

Depreciation Expense & Straight-Line Method w/ Example & Journal Entries

Straight Line Method vs Diminishing Balance Method (Depreciation Calculation Examples)

Straight Line Depreciation Formula

PDF) Capital Allocation Analysis for Utility-like Businesses

How to calculate depreciation under the straight-line method using

:max_bytes(150000):strip_icc()/residual-value-4190131-final-1-c98e52a4e3474d248acab1a8807b1eca.png)

Residual Value Explained, With Calculation and Examples

:max_bytes(150000):strip_icc()/Sum-of-the-years-digits-4188390-primary-final-b5aa6b9fc28a4ba2b1f04d06672b9b20.png)

Sum-of-the-Years' Digits: Definition and How to Calculate

:max_bytes(150000):strip_icc()/salvagevalue.asp-final-292f031e45fc401696a539e78dda392d.png)

Salvage Value Meaning and Example

:max_bytes(150000):strip_icc()/GettyImages-551986071-846eff12544045f9ae9ea825682556e0.jpg)

Book Value vs. Carrying Value: What's the Difference?

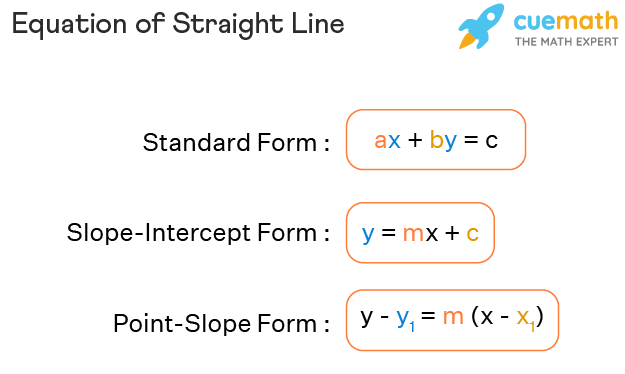

Equation of Straight Line - Formula, Forms, Examples

Related products

You may also like